Understanding mortgage-backed securities

Although complex, mortgage-backed securities can provide diversification in suitable portfolios.

Terms to know before investing

Before investing in mortgage-backed securities, you should have a clear understanding of the terms of the issue.

Type of security

Identify the collateral behind the mortgage bonds, whether purchasing a pass-through or a more complex CMO.

Issuer guarantee

Verify the existence of any guarantee or other credit enhancements and the credit quality of the guarantor.

Quality of security

Understand what types of mortgage loans are held in a pool.

Average life vs. stated maturity

Align average life, which may be shorter or longer than estimated, and the final stated maturity should match an investor’s investment horizon.

YTAL vs. YTM

Compare a yield-to-average-life to a yield-to-maturity of another comparable investment. A YTAL takes into account the return of principal over time, whereas a YTM is the yield based on a bond’s stated maturity date.

More information is available online from the Securities Industry and Financial Markets Association (SIFMA) at projectinvested.com.

Mortgage-backed securities (MBS) and collateralized mortgage obligations (CMO)

While the MBS market is vast, the information you will find here focuses on investments securitized with residential mortgages and covers only the most common types of mortgage securities – those issued by one of the government-sponsored enterprises (Ginnie Mae, Fannie Mae or Freddie Mac), also commonly referred to as GSEs. Private label MBS and other types of asset-backed securities are not part of this discussion.

Creditworthiness

Payments of interest and principal from securities issued by Ginnie Mae are guaranteed by the U.S. government. However, this guarantee applies only to the face amount and not any premium paid, nor does it protect an investor from price fluctuations.

Payments of principal and interest from securities issued by Fannie Mae or Freddie Mac are guaranteed by these government-sponsored enterprises themselves and do not carry any additional guarantee by the U.S. government. Fannie Mae and Freddie Mac are public companies currently under conservatorship of the Federal Housing Finance Agency (FHFA).

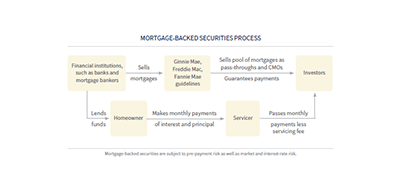

Securitization

Homeownership is a part of the American dream, and financing the purchase of a home is a big part of making that dream possible. Financial institutions generally act as intermediaries between homebuyers seeking to finance a purchase and investors willing to lend for a specific return on their money.

In order to maintain an efficient market, mortgages with similar characteristics are pooled together, packaged into one investment and then sold to investors in the secondary market.

This process, called securitization, is the financial term used for taking cash-flow producing assets (like mortgages), combining them, and transforming them into a pooled security. The principal and interest on this pooled security (more commonly referred to as a pass-through security) are then paid back to the investors through monthly payments of both principal and interest.

Pass-through securities

Groups of similar mortgage loans combined together produce a pass-through mortgage-backed security. A pass-through security makes monthly interest payments, however the principal repayment is amortized over the life of the security. Simply put, principal is returned to the investor as the homeowner repays their loan through their regular monthly mortgage payment, and the bond’s interest payment is computed using the remaining principal on the security.

In a pass-through security, an issuer (servicer) collects homeowners’ monthly payments and passes a proportionate share of the principal and interest back to the bondholders (investors). Most fixed income securities, such as Treasury and corporate bonds, make periodic interest payments and repay the principal on the maturity date or call date.

The pass-through’s principal value is paid back (normally monthly) during the security’s life rather than returned to the investor in one large payment at maturity. It is, therefore, a self-liquidating investment that matures when an investor receives the final principal payment, which may be before the final stated maturity of the bond. Investors who prefer pass-through securities are willing to accept the unpredictable monthly cash flows. Investors may receive additional principal repayment resulting from the sale of property, refinancing, default on a loan, or a homeowner periodically paying additional principal. Some investors may not like to receive a portion of their principal back on a monthly basis. Those who prefer to keep their principal intact for a longer period of time while earning interest should consider the CMO.

Uniform mortgage-backed securities

On June 3, 2019, the FHFA made an important change as to how Fannie Mae and Freddie Mac MBS pools are issued. Under this change, called the Single Security Initiative, Fannie Mae and Freddie Mac now issue uniform securities that have identical characteristics. This change allows either agency to interchangeably deliver their pools versus To-Be-Announced (TBA) markets. These new pools are called Uniform Mortgage-Backed Securities or UMBS and can be backed by 30-, 20-, 15- or 10-year single-family mortgage loans. The result is now a larger more liquid TBA market which is expected to lower the cost of housing finance and benefit borrowers, taxpayers and investors. There is no change to the old Fannie Mae or the Freddie Mac “gold” pools which may be bought, sold or held to maturity. However, if you wish to convert your Freddie Mac “gold” pools to the new UMBS format, a process is available. Contact your financial advisor for details.

Collateralized mortgage obligations (CMOs)

In 1983, a financial instrument designed to meet investor demand for more structured cash flows was created. It became known as the CMO.

The tax reform act of 1986 created real estate mortgage investment conduits (REMICs) designed for collecting mortgage loans and/or pools of mortgages together for issuance into CMO bonds. Since most CMOs are now issued in REMIC form, the terms REMIC and CMO are now used interchangeably.

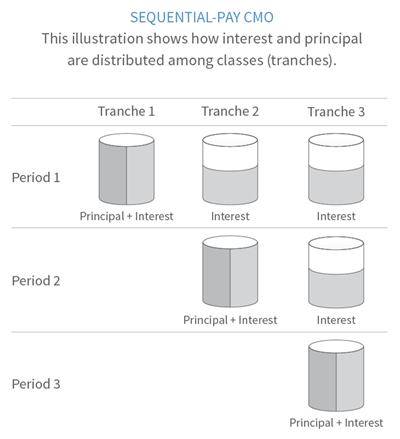

CMOs may be backed by a group of mortgages, by pools of existing pass-through securities, or some combination of both. The principal and interest payments from these mortgages, both scheduled and prepaid, are directed to the CMO classes in a predetermined order according to terms outlined in the prospectus.

Groups of pass-through securities combined together form a collateralized mortgage obligation (CMO).

The class receiving principal repayment is referred to as the “active” or “current paying” class.

The “window” is the period in which principal repayments are expected to occur.

The period when investors receive only interest payments is known as the “lockout period.”

Consequently, you have the ability to purchase a CMO class with characteristics that more closely match your specific investment objectives. These characteristics can include, but are not limited to, classes with short, intermediate or longer average lives, classes with quick return of principal (tight principal window) vs. classes with longer periods of principal payback (wide principal window), and classes with more predictable cash flows vs. classes with less predictable cash flows.

If you purchase CMOs on the first issuance date, you may find your transactions take up to a month to settle due to the time necessary to assemble the collateral, deposit it with the trustee, and complete other legal and reporting requirements. Your confirmation will indicate the settlement date. Certain information, such as the CUSIP and stated maturity date, may not be available at the time of the trade. In this case, an updated confirmation will be issued when this information becomes available.

Evaluation of a mortgage-backed security

The cash flow from mortgage-backed securities (MBS) can be somewhat irregular because the speed and the timing of repayments can vary. Generally, homeowners will prepay or refinance their mortgage loans early if market interest rates decline. If interest rates remain stable or increase, homeowners may put off prepayments until rates decline or other circumstances arise.

A mortgage borrower may also prepay the loan regardless of interest rates, due to personal reasons, such as job relocation, death, divorce or default. The homeowner can also reduce their mortgage faster by making larger monthly payments.

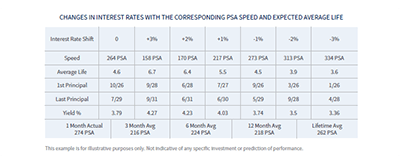

Over the years, many mathematical models have been developed to help predict how fast mortgage loans will be prepaid under different scenarios. These prepayment rates are represented as the Prepayment Speed Assumption (PSA). The higher the PSA number, the faster the principal is being returned to the investor.

Prepayment assumptions may be based on historic prepayment rates for each type of mortgage loan, various economic conditions, and geographic locations of specific properties, among other factors.

MBS market prices and yields depend on prepayment assumptions made by these models. However, because the cash flow on mortgage securities is irregular, if actual prepayment rates are faster or slower than anticipated, the realized yield may be different than estimated.

Investing in mortgage-backed securities requires investors to understand how their bond's performance will change with varying prepayment activity. It is best to review this analysis from time to time to verify that the bond is performing as originally intended. While the final outcome is somewhat unpredictable, it is possible to use both historical and consensus prepayment numbers to analyze potential returns on an individual investment.

The chart shows various changes in interest rates, from increasing 3% to decreasing 3%, with the corresponding PSA speed and expected average life at each interest level. In the example above, the current average life is 4.6 years based on a 264 PSA.

If interest rates were to increase by 3%, you could expect the average life to increase to 6.7 years based on a 158 PSA. As rates increase, prepayments typically decrease (lengthening the average life) since mortgage holders will not generally refinance at a higher rate.

Conversely, if rates were to decrease, prepayments typically increase (shortening the average life) since mortgage holders would typically refinance at a lower rate.

Due to the uncertainty of payments on principal and interest, MBS generally offer competitive returns. Do not invest in MBS if you will need access to funds by a specific date, as the assumptions of homeowners’ prepayments may or may not be met.

The following terms will help you further understand a bond’s PSA analysis:

The Average Life of a mortgage bond is the average time that each principal dollar in the pool is expected to be outstanding, based on an estimated PSA. If the actual prepayment speed is faster or slower than estimated, the average life will be shorter or longer. It is a general practice to quote average life rather than the stated maturity date when evaluating mortgage-backed securities.

Yield-to-Average Life (YTAL) is a standard measure of return used to compare MBS to other fixed income alternatives with similar characteristics. However, average life is only an estimate and largely depends on the accuracy of prepayment speed assumptions.

1st principal is the expected first principal payment based on the PSA

Last principal is the expected final principal payment based on the PSA

1 month actual is the actual PSA for the prior month

Three month, six month, 12 month, Lifetime Avg is the historical average PSA. (updated monthly)

Yield and average life consider prepayment assumptions that may or may not be met. Changes in payments may significantly affect yield and average life.

Examples of more common types of CMO Classes

Sequential Class (plain vanilla) is the most basic CMO structure. Each class receives regular monthly interest payments. Principal is paid to only one class at a time until it is fully paid off. Once the first class is retired, the principal is then redirected to the next class until it is paid off, and so on. The classes are paid off based on their corresponding average maturities, which may be 2-3 years, 5-7 years, 10-12 years, etc. This type of structure may help reduce prepayment variability.

Planned Amortization Class (PAC) offers a fixed principal payment schedule. This is done by redirecting cash flow irregularities caused by faster-than-expected principal repayments away from the PAC class and toward another class referred to as a support (or companion) class.

In other words, two or more classes (PAC and Support classes) are active at the same time. When repayment of principal is less than scheduled, principal is paid to the PAC class while principal to the support class is suspended. With a PAC class, the yield, average life, principal window and principal return lockout periods estimated at the time the deal is structured are more likely to remain stable over the life of the security.

This is accomplished by offering a range of prepayment speeds (e.g., 75% to 300% PSA). As long as principal prepayments fall within the PSA range, the average life and yield will remain constant. Since PAC classes offer the highest degree of stability, they offer lower yields than other classes. PAC II classes were created to offer investors slightly higher yields, but they offer less stability. The typical PAC II class will have a narrower PSA “band” (e.g., 100% to 210% PSA).

Targeted Amortization Class (TAC) offers payment stability at one prepayment speed instead of a range (e.g., 200% PSA). If PSA deviates from a predetermined rate, TAC investors may receive more or less principal than expected. The degree of payment certainty of these classes depends on the overall CMO structure and the presence of PAC classes. If a CMO structure contains both TAC and PAC classes, TAC investors may experience higher principal payment fluctuations. As with PACs, any shortfall or excess of principal payments is absorbed by support classes. TACs are typically offered at higher yields than PACs, but lower yields than support classes.

Support (or Companion) Class – Any CMO structure that has PACs or TACs will also have support classes. These classes are designed to stabilize the principal payments of PAC and/or TAC classes. Payment variability is redistributed rather than eliminated or reduced. Supports are typically less predictable than other classes because they are designed to absorb any deviation from prepayment assumptions. Most support classes have a targeted average life; however, the average life can extend or shorten if prepayment speeds become volatile. Support classes can either absorb excess mortgage payments (shorten their average life) or have their average life extended in periods of lower prepayment activity. As a result of this inherent volatility, support classes generally offer higher yields and may be suitable for investors who do not expect steady income payments and have a flexible time horizon.

Benefits and risk considerations

Mortgage bonds with higher coupons generally have a shorter average life based on higher prepayment speed estimates. It is assumed that homeowners whose mortgage rates are higher than prevailing rates will refinance or pay off loans faster. In contrast, homeowners tend to hold on to low rate mortgages, resulting in a longer average life of MBS securitized by those loans.

Flexibility

From basic pass-through securities to more complex CMO bonds, MBS investors can choose to approximate potential maturities and cash flow schedules to better fit their individual investment objectives.

Monthly income

Mortgage-backed securities offer competitive returns, but with less predictability of interest and principal payments than other types of fixed income securities. Interest income is paid monthly on the outstanding principal value. While the coupon rate is set at the time of issuance, monthly payments, which include interest and principal, may vary. MBS may be suitable for investors with a flexible time horizon.

Self-liquidating investments

MBS generally do not return principal in one lump sum on the maturity date. Principal is returned periodically, potentially allowing an investor to reinvest it prior to maturity. These securities mature when the last payment of interest and principal is paid to investors.

Prepayment risk

Prepayment risk is the risk that the homeowners will pay off their mortgages faster by making higher-than-required monthly payments, refinancing or selling the property. Prepayments usually occur when interest rates decline. As the principal is returned sooner than expected, MBS holders may be forced to reinvest at prevailing lower yields.

Extension risk

Extension risk is the risk that the homeowners will not pay off their mortgage loans as soon as expected, resulting in lower PSA estimates and extension of the average life. If this occurs, mortgage investors may end up holding bonds with maturities longer than expected and the yield may or may not keep up with rising inflation or market interest rates.

Interest rate risk

Market values of mortgage bonds are more sensitive to movements in interest rates than other fixed income securities. Rising or falling interest rates have a trickling effect on MBS prices, as they affect the underlying mortgage loans – the rate at which they are prepaid and, hence, their average life.

Credit quality

Although not rated by nationally recognized rating agencies, GSE-issued mortgage securities are backed by financial assets that are designed to generate a cash flow. These assets include single-family mortgages, multifamily mortgages and commercial mortgages. Payments of interest and principal are assured by the issuer. As a reminder, only Ginnie Mae securities are direct obligations of the U.S. government, and even these are subject to market risk. To reduce the risk of default, some homeowners are required to carry mortgage insurance if the mortgage loan amount exceeds 80% of the home value. According to the Census Bureau, more than 64.8% of Americans own a home (as of March 5, 2022). For additional information, please also refer to the “Creditworthiness” section in this document.

Liquidity

While not obligated to do so, many broker/dealers participate in the secondary market for mortgage-backed securities. Investors may sell their bonds prior to the stated maturity date at prevailing market prices. As with other fixed income securities, secondary market prices of pass-throughs and CMOs react to changes in interest rates. As rates increase (decline), MBS market prices fall (rise). Additionally, CMOs may be less liquid because of the complexity of each tranche, which may or may not find demand in the secondary market. Proceeds from a sale may be more or less than the original investment.

Taxation

The interest portion of income payments is fully taxable. Payback of principal is not taxable unless mortgage bonds were purchased at a discount from par. Tax implications regarding interest income, return of principal, original issue discount as well as purchases at a discount or premium may be more complex for MBS investors, thus you should seek professional tax advice prior to investing. You should expect to receive 1099-INT and/or 1099-OID and they will be mailed to you prior to March 15th.

Want to learn more?

Your financial advisor will answer any questions you may have, and more information is available at the Securities Industry and Financial Markets Association (SIFMA) at projectinvested.com.

Next