Raymond James Debit Card

Your security is our priority

The chip on your new Capital Access Visa® Platinum debit card makes your card nearly impossible to counterfeit, so you can make your purchases with confidence. As before, your new card comes with $0 liability. This means you’re not responsible for any fraudulent charges.

Using your new chip card is easy

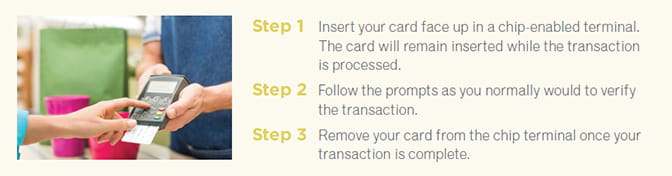

Your card still has a magnetic strip, so you can continue to swipe your card to make payments the same way you always have. For merchants accepting chip transactions, follow these easy steps:

Chip card FAQ's

Why does my Raymond James debit card now have a chip?

The U.S. is shifting to chip cards used at chip-enabled readers because chip technology has proven successful in reducing fraud in over 130 countries around the world. Many countries worldwide have adopted chip technology, and it will become the security standard for card payments in the U.S.

What is a chip card?

It is a card that has a chip on the front as well as the traditional magnetic strip on the back. The chip provides added security when used with a chip-enabled terminal or ATM. The chip protects in-store payments because it generates a unique, one-time code needed for each transaction to be approved.

How does the chip make my card more secure?

A chip transaction adds another layer of security to cards by requiring the chip to produce a single-use code to validate the transaction – further protecting your card from unauthorized use. This process makes your chip card information more difficult to steal and therefore makes your chip card more difficult to counterfeit.

Will chip cards prevent third-party data breaches?

Chip card technology provides an additional layer of security to help reduce certain types of fraud resulting from data breaches; however, it will not prevent a data breach.

What information is stored on the chip?

The chip stores information needed to complete your purchase, such as card number and expiration date.

Will chip cards allow others to track my location?

No. Chip card technology is not a locator system. The chip on your card is limited to supporting authentication of card data when you make a purchase.

Chip card, EMV card, smart card … what’s the difference?

These are all just different terms for the same technology. The technology used in these credit cards is commonly known as EMV-enabled, which stands for Europay, MasterCard and Visa, which uphold the chip technology. These cards are a global standard for processing credit and debit card payments.

How does the U.S. point-of-sale counterfeit liability shift work?

Effective October 1, 2015, Visa’s global point-of-sale counterfeit liability shift will be effective in the U.S. With this liability shift, the party that is the cause of a chip transaction not occurring (i.e., either the issuer or the merchant’s acquirer) will be held financially liable for any resulting card present counterfeit fraud losses.

Will my new chip card be covered under the Visa Zero Liability policy?

Yes, like all Visa cards your new chip card will be protected under the Visa Zero Liability policy. You must notify Raymond James promptly of any unauthorized use.

Using chip cards

Where can I use my chip card?

You can use your chip card anywhere Visa cards are accepted. Many merchants across the U.S. are beginning to accept chip card transactions and this will continue to grow within the coming years. Your chip card will still work at terminals where only magnetic strip transactions are accepted.

How do I pay at a chip-enabled card reader?

Instead of swiping the card at the merchant card reader, you’ll insert it into the slot in the front of the chip card reader. Leave the card in the chip card reader until your purchase is complete. If a signature is required, just sign, and always remember to take your card when you’re done.

How do I pay at a card reader that is not chip-enabled?

Your card will also have a magnetic strip on the back, so you can still swipe your card at a traditional card reader, just as you would today.

How does a chip card work for Internet and telephone transactions?

Your Internet and telephone transactions will work just as they do today.

What about recurring payments on my old card?

Just like anytime you get a new card, notify the merchants that charge your card, give them your card number, expiration date and the 3-digit security code.

Do I need to use a PIN with my Visa chip card?

In most cases, you’ll either sign or enter your PIN to complete your purchase – just like you do today. You may not be required to do either for certain types of transactions involving relatively small purchase amounts.

What if my chip card doesn’t work when I insert it into the chip terminal?

Some merchants may have chip terminals, but they may not yet be activated to accept chip cards. If you are unable to insert your chip card into a chip terminal, you can always swipe your card to complete the transaction. Most often, merchants that haven’t activated their terminals will block the chip slot.

Now that I have a chip card, should I continue to notify Raymond James when I travel internationally?

Yes, you should continue to provide Raymond James with advance notification of plans to use your Visa debit card when traveling internationally.

Do I still need to sign the back of my card?

Yes, you need to sign the back of your card for security purposes.

Debit card text alerts

With automatic security alerts, you receive leading-edge fraud detection via your cellphone.

How much does it cost to use this service?

Raymond James does not charge for this service. However, standard text message and data rates assessed by your mobile carrier may apply. Please check with your mobile carrier to ensure you have text messaging service on your monthly mobile phone plan.

How do I register?

1) Login to your Client Access Capital Access account and Click “Register Here” under the Debit Cart Alerts section 2) Enter the requested information 3) Click submit

What carriers currently participate in this service?

T-Mobile, Verizon Wireless, AT&T, Sprint, Interop – Appalachian Wireless, US Cellular Corp®, Cincinnati Bell, Boost Mobile, Cricket Communications, Nextel Communications, Virgin Mobile USA, ALLTEL Communications Inc.

How long should it take to receive a text message (SMS)?

Typically, responses arrive within a minute, but timing may vary.

How often should I receive text messages (SMS) from this service?

Message frequency will depend on account settings.

I enrolled in the service online and never received a text message to complete my registration … why?

Your mobile phone may be blocked from receiving third-party text messages. Check with your carrier and ask them to remove the block from your phone.

What if I do not have text messaging?

Text messaging is required for this service. If your mobile phone is able to send and receive text messages, but you do not subscribe to this service, you will need to contact your mobile phone provider to add a text messaging feature to your phone plan. Your phone carrier may charge additional fees.

If I am traveling outside of the U.S., can I receive text message alerts?

Messages are only sent via U.S. carriers and will only be receivable in the U.S. Some messages on U.S. carriers may be received while traveling; however it will depend on that carrier's coverage area.

What will trigger the messages and will every message require a reply?

Fraud Alert messages will be sent when any suspicious activity occurs on your Raymond James debit card. They will require a text message reply to verify whether the subject transactions are authorized. Consumer Preference messages will be sent when debit card activity meets any of the criteria and/or thresholds that you selected during the optional Consumer Preference Alerts registration. These messages will not accept a reply, but our phone number is included in the event there is unauthorized activity.

Are the text commands case-sensitive?

No. Commands can be sent as upper-case, lower-case or a mixture of both.

Can I add multiple phone numbers?

No. Only one mobile phone number per debit card account can be registered with this service.

If my mobile phone number changes, what do I need to do?

In order to receive alerts to your new number, you will need to re-register your new mobile number. You will be able to update the number on your existing profile.

Why do I receive multiple messages with Pg1/2, Pg2/2?

Text messages are unique in that they can only hold 160 characters. Some commands require multiple messages to return all of the necessary information.

Is this service safe and secure?

Yes. Our first priority is to protect your personal information. We never ask for your account number, personal identification or other personal information. If you ever receive a text message asking for your member number, account numbers or other personal information, please do not respond.

How do I unsubscribe?

Send a text that says STOP to 57455. You will receive an opt-out confirmation.

PIN Now

An automated service allows you to customize your debit card PIN 24/7 by phone.

PIN Now

Activate your card and customize your PIN by using our automated service 24 hours a day, 7 days a week by calling 877.315.3483.

In order to activate your Raymond James debit card or select a PIN, you will need to provide the following information for the primary cardholder on the account:

- The last four (4) digits of your Social Security Number

- Date of Birth

- The three (3) digit code on the back of the card near the signature line

- ZIP code

Reissued debit cardholders need only to activate the card. Your current PIN will remain the same unless you wish to change it.

New debit cardholders will need to activate the card and select a PIN of their choice.

By activating one card, all cards associated with that account are activated. Accounts with multiple cardholders will select a unique PIN for each card.

PIN numbers may only be changed once per day.

Never write your PIN on your card.

To report a lost or stolen Capital Access Visa® Platinum debit card:

Within the United States, call toll-free: 800-759-9797

Outside the United States, call: 727-567-3353