Step-up Bonds

Introduction to Step-up Bonds:

At the most basic level, step-up bonds have coupon payments that increase (“step-up”) over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period. Step-up bonds may reset once or reset multiple times (multi-step bonds) during the life of the bond. Common issuers are Government Sponsored Enterprises (GSEs) as well as corporations.

Step-up bonds can potentially provide:

• Higher coupons and increasing income streams vs. fixed coupon alternatives.

• Potential for higher returns versus comparable non-callable securities.

Risk/Rewards of Step-up Bonds:

Some bond characteristics may vary such as payment frequency and cash flow. Step-ups generally provide a greater overall weighted average coupon versus fixed coupon bonds with similar maturities. The relative value of a step-up bond will depend on the holding period, the coupon and the expectation of future interest rates. As with any callable bond, the price of a step-up bond is determined in part by the credit risk of the issuer, the prevailing level of interest rates and the value of the embedded call option. When the bond steps-up (coupon increases), the potential for the issuer to exercise the call also increases. Also, it is possible that when the bond steps-up, the increase in coupon may not keep up with prevailing interest rates. These higher potential risks are typically offset by a greater upfront coupon.

An Example of a Step-Up Bond:

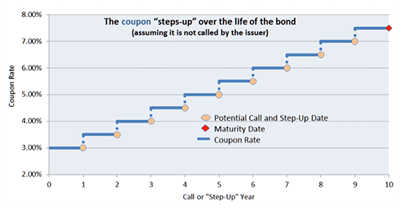

The table below details 10-year step-up bond with yearly call dates and coupon “step-ups”. In this example, the coupon rate increases by 50 bps each year if the issuer does not call the bond on the stated call date. If the issuer chooses to call the bond, the investor will receive par value.

(The above is a hypothetical example for illustrative purposes only. It is not intended to reflect the actual performance of any security. Investments involve risk and you may incur a profit or a loss.)

Conclusion:

Step-up bonds may attract investors looking for a coupon higher than the existing fixed coupon alternatives. The benefit of a potentially higher future coupon mitigates the risk of rising interest rates. The coupon may or may not keep pace with prevailing interest rates; however, a predictable cash flow and income can be gauged during the holding period for any period of time.