Pricing Factors

Factors That Affect Prices of Fixed Income Securities

What you need to know about the risks of fixed income investing

Fixed income securities, an integral part of well-balanced and diversified portfolios, afford opportunities for predictable cash flow to match investor needs, provide a means for capital preservation and may offset the volatility of equity holdings. As with all investments, fixed income securities have some degree of risk. In general, the higher the risk, the higher the potential return. By contrast, low risk investments usually offer relatively lower returns.

There are a number of variables to consider when investing in bonds as they may affect the realized return. These variables include, but are not limited to: changes in interest rates, coupon payments, maturity, redemption features, credit quality/rating, market price, priority in the capital structure and/or source of repayment. When holding fixed income securities to maturity, many of these variables become fixed such as cash flow, income (yield) and the return of face value; however, some common risks associated with fixed income securities affect pricing during the life of the bond and therefore potential returns if they are sold prior to maturity.

Interest Rate Risk

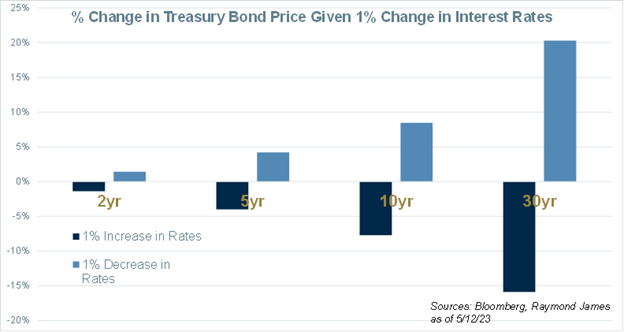

The market price of a bond is inversely affected by interest rate movements. When interest rates rise, a bond’s price generally falls and conversely, when interest rates fall a bond’s price tends to rise. This price movement keeps a bond’s yield current. Since most coupons are fixed, the price of a bond moves up or down affecting the yield in a manner that keeps it relevant with constantly changing interest rates. For example, if interest rates rise, a newly issued bond would reflect the market’s higher yield. Existing bonds would see their price fall to the extent that their yield stays current with the prevailing higher interest rate environment.

Market Risk

Investors who need access to their initial investment (principal) prior to maturity are subject to market risk. The value an investor receives upon the sale of their bond relies on the secondary market when their bond is sold and may be more or less than the original purchase value depending on several factors. First of all, there is typically a difference (spread) between the bid (what someone is willing to pay) and offer (where someone is willing to sell) on any bond. This implies that the price at which you may be able to sell a bond is likely to be lower than the price at which you purchase a bond; however, changes in the level of interest rates may have a much greater impact on a bond’s price.

The longer the maturity on a bond, the more market risk that is associated with the bond. There simply is more time for changes to affect a bond’s price. As a result, longer maturities may see bigger price fluctuations versus shorter maturities for the same amount of interest rate change.

Other market conditions can also affect pricing. Limited supply of a particular bond will generally create more price volatility versus a bond with plenty of supply. A large block ($500,000) of corporate or municipal bonds may trade in a tighter price range versus a small block size ($10,000).

Credit Risk

The credit quality of an issuer affects bond pricing. Two bonds of identical coupon and maturity may be priced differently because of the credit quality or potential risk of missing interest and/or principal payments. Of course most of our clients’ investments are investment-grade (lower risk for default) but the more financially sound an issuer, the higher the price (lower yield) of the bond. The more financially questionable an issuer is, the lower the price (higher yield) of their bond.

A change in either the issuer’s credit rating or the market’s perception of the issuer’s overall risk position will affect the pricing of its outstanding bonds. Ratings are intended to reflect the issuer’s overall risk profile on a relative basis. Companies such as Moody’s and Standard & Poor’s provide rating rationale in much more detail explaining how they derive on the bond’s publicized rating. Ratings are not a recommendation to buy, sell or hold and may be subject to review, revision, suspension or reduction, or may be withdrawn at any time.

Some municipal bonds carry insurance in which case, the overall rating may be different than the underlying rating which is a reflection of the creditworthiness of the obligor.

| Bond Credit Quality | ||

|---|---|---|

| Investment Grade | ||

|

Moody’s |

S&P |

Fitch |

|

Aaa |

AAA |

AAA |

|

Aa1 |

AA+ |

AA+ |

| Aa2 | AA | AA |

|

Aa3 |

AA- |

AA- |

| A1 | A+ | A+ |

| A2 | A | A |

| A3 | A- | A- |

|

Baa1 |

BBB+ |

BBB+ |

|

Baa2 |

BBB |

BBB |

|

Baa3 |

BBB- |

BBB- |

| Below Investment Grade | ||

| Ba1 | BB+ | BB+ |

| Ba2 | BB | BB |

| Ba3 | BB- | BB- |

|

Caa1 |

CCC+ |

|

|

Caa2 |

CCC |

CCC |

|

Caa3 |

CCC- |

|

|

Ca |

CC |

|

| C | ||

| C | DDD | |

| D | DDD | |

| DDD | ||

source: SIFMA, Raymond James

Default Risk

Default risk goes hand-in-hand with credit risk. It is the risk that the issuer will not be able to make interest payments and/or return the original face value at maturity. Bonds with higher default risk will be rated very low in the below investment grade rating categories listed in the box. Investors in risky rated bonds (sometimes referred to as junk bonds) demand higher potential returns and therefore pricing will usually provide relatively higher yields versus higher rated or investment grade credit quality bonds.

Reinvestment Risk

Downward trends in interest rates can create reinvestment risk or the risk that the income and/or principal repayments will have to be invested at lower rates. Reinvestment risk is an important consideration for callable bonds. A bond with a call option allows the issuer to redeem the bonds prior to the maturity date. An issuer would be incentivized to call a bond before maturity when interest rates fall, theoretically allowing the issuer to issue new bonds at a lower cost. The existence of this investor risk influences the price of a bond carrying it. As an investor, you want to protect a higher yield in a falling interest rate environment and avoid having to reinvest into a lower one.

Prepayment Risk

Prepayment risk is similar to reinvestment risk where the issuer repays bonds prior to maturity. For example, in a mortgage-backed security, underlying collateral (home mortgages) may be repaid ahead of schedule. As this collateral is repaid, a mortgage-backed investor receives some of their investment early, forcing reinvestment of principal at a time when it may or may not be advantageous as it depends on the current interest rate environment. Securities subject to additional risks such as prepayment risks may demand more potential return, thus affecting the price of such bonds.

Capital Structure (Source of Repayment)

The capital structure of a corporation provides a sort of road map to the debt’s pecking order should a corporation run into financial difficulty. For a municipality, the source of payment identifies where the funds are derived to pay the investor. This could be through a source of defined revenue such as a toll or through the general obligation of the municipality itself. The repayment priority of a bond will affect its pricing. More secure (less risky) debt will carry lower yields relative to the less secure (higher risk) debt that is placed lower in capital structure or with less ranking in a municipality’s financial structure. In general, bonds (debt) are ranked higher than preferred securities which are above common stocks. The source of repayment with municipal bonds must be evaluated on an individual basis. In theory, general obligations have the taxing power to raise revenue whereas a revenue bond has a specific revenue generator to support its debt payments. The rating agencies (Moody’s, S&P, Fitch), FINRA (www.finra.org) and the Municipal Security Rulemaking Board (www.msrb.org) provide additional sources of information for evaluation.

| Typical Corporate Capital Structure |

| Senior Secure Debt |

| Senior Unsecured Debt |

| Senior Subordinated Debt |

| Junior Subordinated Debt |

| Preferred Securities |

| Common Equity |

Take-away

The real and perceived risks associated with any asset affects the value of that asset. Bonds are no exception. Risk is not necessarily bad but rather a financial tool to assist investors in aligning their investment objectives with a bond’s investment characteristics that will optimize returns. Understanding how these factors affect the pricing of bonds improves an investor’s ability to buy the bonds (or any other asset) that complement their personal objectives. Bonds are not a “one size fits all” asset class. Understanding the nuances and distinguishing features of a bond embodies the mantra, “know what you own”. By knowing what you own and how outside forces affect what you own, the likelihood of meeting investment objectives and goals may be heightened.